Real estate investment has long been a favored avenue for potential appreciation and steady cash flow. However, as investment goals evolve or specific real estate holdings mature, the prospect of capital gains taxes and depreciation recapture becomes a concern. One strategic solution gaining traction is the Umbrella Partnership Real Estate Investment Trust (UPREIT) option within a Delaware Statutory Trust (DST). In this article, we explore the unique advantages of UPREITs, shedding light on their tax-deferral benefits and how they can enhance portfolio strategies.

UPREITs and Section 721 Exchanges:

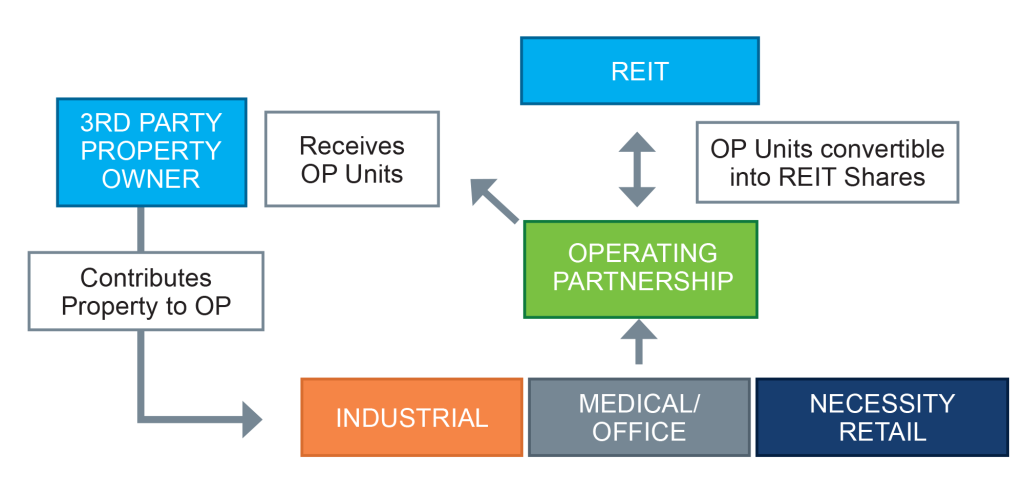

UPREITs operate under Internal Revenue Code (IRC) Section 721, enabling property owners to exchange their real estate assets for share ownership in a REIT. The property contributor receives operating partnership (OP) units in the REIT, and this process avoids triggering immediate tax liabilities. The capital gains are deferred until the investor sells the OP units, converts them into REIT shares, or the REIT’s operating partnership sells the contributed property.

This is similar to the Section 1031 Exchange in that it allows for the deferral of capital gains taxes when exchanging real property. But rather than exchanging real property into a like-kind asset, the 721 Exchange helps exchange appreciated real estate into a real estate investment trust. This unique REIT structure not only offers diversification and the potential for stable returns but also provides an effective strategy for deferring capital gains taxes.

Mechanics of UPREIT Transactions:

UPREIT transactions can potentially stabilize cash flow by transitioning from physically owned real properties to a diversified passive investment in a REIT. REITs often distribute dividends to shareholders, providing a consistent income stream. Many REITs are publicly traded, enhancing accessibility for investors. This allows them to exchange units for shares, which can be sold on the market, potentially earning a profit.

UPREITs offer unique tax-deferral partnerships, allowing investors to defer capital gains until specific triggering events occur, such as the sale of OP units or conversion into REIT shares. A typical candidate for an UPREIT transaction owns a single tenant net-leased property, a portfolio of properties, or interest in a DST. By exchanging their ownership interest, investors receive REIT operating partnership (OP) units that are convertible into common shares. Investors can continue to defer taxes as long as they hold the OP units. The taxable event is triggered only when these OP units are converted into common shares of the REIT. Upon selling shares, investors can earn the difference between the original share value and the market value at the time of sale, potentially realizing a profit.

Strategic Considerations:

While UPREIT transactions share similarities with Section 1031 Exchanges, the key distinction lies in the nature of the exchanged assets. A 1031 Exchange involves swapping real property for like-kind assets, while a 721 Exchange enables the exchange of appreciated real estate into a real estate investment trust.

UPREIT transactions offer compelling advantages but proper structuring is crucial. Moving investment property or Delaware Statutory Trusts (DSTs) through a 721 Exchange requires careful consideration and should be conducted with the guidance of tax specialists and registered advisors. By leveraging the unique benefits of UPREITs, financial professionals and accredited investors can strategically navigate the intricacies of commercial real estate investing, contributing to an effective and tax-efficient portfolio strategy.